During

the eighteen months after January 2007, cereal prices doubled, setting

off a world food crisis. In the United States, rising food prices have

been a pocketbook annoyance. Most Americans can opt to buy lower-priced

sources of calories and proteins and eat out less frequently. But for

nearly half of the world’s population—the 2.5 billion people who live

on less than $2 per day—rising costs mean fewer meals, smaller

portions, stunted children, and higher infant mortality rates. The

price explosion has produced, in short, a crisis of food security,

defined by the Food and Agriculture Organization (FAO) as the physical

and economic access to the food necessary for a healthy and productive

life. And it has meant a sharp setback to decades-long efforts to reduce poverty in poor countries.

What we are witnessing is not a natural disaster—a silent tsunami or a perfect storm. . . . [The food crisis] is a man-made catastrophe, and as such must be fixed by people.

-Robert Zoellick, The World Bank (July 1, 2008)

The

current situation is quite unlike the food crises of 1966 and 1973. It

is not the result of a significant drop in food supply caused by bad

weather, pests, or policy changes in the former Soviet Union. Rather,

it is fundamentally a demand-driven story of “success.” Rising incomes,

especially in China, India, Indonesia, and Brazil, have increased

demand for diversified diets that include more meat and vegetable oils.

Against this background of growing income and demand, increased global

consumption of biofuels and the American and European quest for energy

self-sufficiency have added further strains to the agricultural system.

At the same time, neglected investments in productivity-improving

agricultural technology—along with a weak U.S. dollar, excessive

speculation, and misguided government policies in both developed and

developing countries—have exacerbated the situation. Climate change

also looms ominously over the entire global food system.

In

short, an array of agricultural, economic, and political connections

among commodities and across nations are now working together to the

detriment of the world’s food-insecure people.

* * *

Cereals

form the core of the global food system. In 2007 the world produced a

record 2,100 million metric tons of grain. Most of these cereals were

consumed in the countries in which they were produced. Some 260 million

metric tons, or about 15 percent of production, were traded

internationally. Food aid was about 6 million metric tons, about 0.3

percent of production. Although only 15 percent of production is traded

in global markets, conditions in those markets have a large direct and

indirect impact on cereal prices and demand in every country.

A world with oil at $125 per barrel, gasoline at $4 per gallon, and corn at $6 per bushel seemed unthinkable five years ago.

World

grain production was exceptionally strong in 2007, and had actually

grown in five of the eight years prior to 2007. Despite this success,

demand exceeded supply in six of those years. This excess demand was

met by drawing down global reserves. When, in 2007, the

reserve-to-usage ratio dropped to a near-historic low, buyers and

sellers reacted in ways that rapidly pushed up prices. Nonetheless, the

current crisis of food security is not a result of some absolute shortage of basic staples. If all the cereals grown in 2007 had magically been spread equally among earth’s 6.6 billion persons and used directly as food, there

would have been no crisis. Cereals alone could have supplied everyone

with the required amounts of calories and proteins, with about 30

percent left over. (Children would have also needed some concentrated

calories and proteins, because of the bulkiness of cereals and their

inability to consume sufficient quantities of them.)

Of

course, food is not distributed evenly across the globe. Average income

levels as well as income inequalities vary by country and are major

determinants of access to food. And because cereals and oilseeds can be

used in multiple ways, not only for food, competition for these

commodities spans many different firms and households. These pressures

on supply and price are powerfully exemplified by the case of corn,

whose price dramatically affects the broader structure of global food

markets.

Corn is quintessentially American. It is the

country’s largest crop in terms of area: in 2007, 94 million acres

produced a record 330 million metric tons of grain. How is it possible

that a record U.S. corn crop was centrally involved with the current

high food prices? The answer lies mostly in corn’s versatility. It

provides about half of the 18 million metric tons of sweeteners that

Americans consume annually, much of it in the ninety-six gallons of

beer and soda they drink per capita. Some 46 percent of the crop went

to feed livestock to produce the 270 pounds of pork, poultry, and beef

the average American consumed in 2007, and about 19 percent went for

exports. Ethanol, which had taken only a tiny fraction of corn output a

few years earlier, took a full 25 percent.

A world with

oil at $125 per barrel, gasoline at $4 per gallon, and corn at $6 per

bushel (fifty-six pounds) seemed unthinkable five years ago. A new

constellation of market forces has drastically altered price levels and

the correlations among them. In particular, the enormous growth in the

use of corn for fuel now links corn and gasoline prices in profoundly

important ways.

The current corn-petroleum price

connections in the United States arguably can be traced to the 2005

environmental regulations to eliminate methyl tertiary butyl ether

(MTBE) as a gasoline additive because of environmental and health

risks. Corn-based ethanol has since become the preferred additive,

offering the same octane ratings and beneficial properties as MTBE.

Ethanol is typically used in the form of a 10/90 mixture with gasoline,

and consumers pay for this ethanol as they fill their cars with fuel at

the pump. As gas prices rise, so does the potential value of corn

ethanol. Most of the ethanol now produced—some 6.5 billion gallons from

the 139 plants in operation in 2007—was used as an oxygenate for the

142 billion gallons of fuel used by Americans last year.

China

imported an incredible 34 million metric tons of soybeans for its pigs,

poultry, and farmed-fish sectors and also its expanding urban

population.

The sudden burst in demand explains the

rapid increase in the portion of the corn crop being used for fuel.

That demand might be expected to level off, as the market for additives

will largely be supplied by 2009. But the United States is now poised

on the brink of a second phase of ethanol use.

Ethanol can

also be used in place of gasoline, even though it provides only about

two-thirds the energy of gasoline on a volume basis. In other words,

rational consumers would pay about 65 percent of the price of gasoline

for their ethanol, since their cars would go about 65 percent as far on

a tank of fuel. Because ethanol must be shipped and stored separately,

only with substantial new infrastructure could ethanol be a large-scale

choice for fuel. And cars would require so-called “flex” technology to

use fuel containing high percentages of ethanol.

Whether

more than 25 percent of the corn crop is used for fuel in the future is

critically dependent on the price of oil and also on the politics of

biofuels. The latter include mandatory minimum levels of ethanol

production and the explicit and implicit subsidies contained in various

pieces of agricultural and energy legislation. Senators McCain and

Obama both expressed strong support for ethanol in the politically

important Iowa caucuses.

The ethanol-production mandate

for 2008 is 9 billion gallons. That number will grow to 15 billion

gallons in 2015 and 36 billion (total renewables) in 2022. Rescinding

these increased mandates would likely stabilize demand for corn-based

ethanol. (High enough oil prices, coupled with low enough corn prices

could, of course, make ethanol economical even at 65 percent of the

efficiency of gasoline.) But if the higher mandates are indeed imposed,

then an increasing portion of the U.S. corn crop will be fed to cars,

rather than to animals or people. Consumers of corn tortillas in poor

countries will find themselves increasingly in competition with S.U.V.

owners in rich countries. At the margins that matter, corn prices would

be linked to gasoline prices, and the entire price structure for

cereals would adjust accordingly.

In

addition to mandates, current legislation also provides for credits

(subsidy) of $0.51 per gallon to blenders and a $0.54 per gallon tax on

imported ethanol plus a 2.5 percent additional duty on its value. Thus,

in the United States, the economics of ethanol are fundamentally linked

to specific legislative provisions. And what Congress has given,

Congress can also take away.

Whether the mandates should

be waived, the tariff on imported ethanol dropped, and the blender

credits modified are all matters of intense debate. Corn farmers and

investors in some 200 bio-refineries (on-line or under construction)

are pushing for higher mandates; others believe that corn-based

ethanol, however well-intended, is the wrong way to promote U.S. energy

independence because of ethanol’s effect on food prices. The stakes are

huge. The United States is by far the largest corn exporter in the

world. Further reductions in exports resulting from greater ethanol use

would greatly amplify price instability in corn and other global food

markets.

Many technical experts have argued that corn is

not the appropriatecommodity for use in biofuels. However,

industrial-scale production from sources other than corn (and sugar) is

as yet unproven. Although the chemistry for alternative feedstocks has

been developed, credit-worthy business plans, including supply chains,

have not. Proponents of other crops tend to overlook the extensive

experience the corn industry has had with enzyme technologies that

derive from its twenty-five-year history making corn sweeteners. As a

consequence, and for better or worse, larger biofuel mandates mean a

corn-dominated ethanol industry for at least the next five years,

accompanied by the inevitable price pressures on food.

Very

poor consumers in low-income countries rarely consume meat of any sort,

and for them [cereal] cutbacks may be an encouraging sign: their best

hope is more grain available on world markets.

An

additional oil-corn connection is also important for farmers. The high

oil prices that help drive the demand for biofuels also raise the

energy costs of growing corn. Corn prices that have risen from less

than $3 per bushel in 2005 to over $7 per bushel in 2008 have been a

boon to farmers. Yet farmers (sometimes on their way to the bank!) are

quick to point out that high oil prices are strongly and negatively

affecting their businesses. Iowa State University maintains farm

records that indicate the total cost for growing an acre of corn was

$450 in 2005. By 2008, these costs had risen to more than $600 per

acre. Seed and chemical costs have accelerated sharply and now

constitute some 45 percent of total costs, including land-rental

charges. Nonetheless, with rising yields and corn prices that have more

than doubled, corn-based farm enterprises seem clearly better off in

2008 than in 2005.

Ethanol, then, is the beginning of the

corn story, but far from the end of it. Corn’s other linkages to

soybeans, wheat, and meat illustrate why it is the keystone in the food

system. Midwestern farmers produced the record corn crop in 2007 in

anticipation of high prices. But the focus on corn implied a series of

acreage decisions that reverberated around the world. The more than

15-million-acre increase in corn planting came mainly at the expense of

soybeans, which saw a decline of twelve million acres, or 16 percent of

total soybean acreage. The United States consequently played a reduced

role as a soybean exporter. Brazil, another major exporter, picked up

some of the slack. Nonetheless the world’s production of soybeans

declined in 2007 while three of the four largest countries in the

world—China, India, and Indonesia—registered very strong economic

growth. China imported an incredible 34 million metric tons of soybeans

(45 percent of total world trade), which it used to produce soybean

meal for some of its 600 million pigs and its large and rapidly growing

poultry and farmed-fish sectors and also vegetable oil for its

expanding urban population. In India and Indonesia, oilseed demand was

driven less by livestock-feed requirements and much more by human

demand for vegetable oils. India, for example, is one of the world’s

largest users and importers of cooking oils.

The

tightened supply of vegetable oils and the accelerated Asian demand for

oilseed crops—soybeans, rapeseed, and palm oil—explain some of the

price increases. For example, during the period July 2006 to June 2008,

oil palm prices tripled. But as with corn, the use of oilseed crops in

the production of fuel—about 7 percent of global vegetable oil

production went to biodiesel—was another significant factor. Most of

the latter was driven by biodiesel policies in Europe, using rapeseed

(canola) as the main feedstock.

Prospects for lowered

vegetable oil prices in the short run, like those for corn, are not

obvious. U.S. farmers rebalanced their plantings in 2008, in part

because of a late spring and in part because soybean prices had risen

to $13 per bushel, making it again an economically attractive crop for

farmers. Brazil continues to expand soybean acreage in several states

as well, but, interestingly, the most likely sources of greatly

increased vegetable oil supplies will come from Indonesia and Malaysia.

Palm oil has long been among the cheapest sources of vegetable oil, and

Indonesia has been planning a major expansion of area devoted to oil

palm production. This expansion is complicated, however, by the

potentially high environmental costs of clearing tropical forests, and

because palm trees take up to three years before they yield economical

harvests. Indonesia had originally planned the oil-palm expansion for

biodiesel production for European and domestic fleets; however, the

food value of vegetable oils has been so high that it does not pay to

make biodiesel. So the expansion goes forward, but with food in mind

more than fuel. As a consequence, supply/demand balances for oil palm

may change appreciably in five years, although it is not at all clear

that near-term supplies of vegetable oil can be accelerated very much.

In

addition to fuel and oils, wheat prices, which went off the charts in

2008, are closely tied to the corn economy. Corn and wheat are both

used by the animal-feed industry, and, in some years, one quarter of

the wheat crop is fed directly to animals. As the cost of using corn

for feed rose in 2007, producers of livestock products looked to other

grains. Since the feed value of wheat is slightly higher than that of

corn, it is not surprising that their prices initially moved in tandem

as livestock producers moved among markets to find the cheapest rations

for their animals.

The wheat market has several

distinguishing features. For example, soft wheat is used primarily for

pastries (and feed), whereas hard wheat is preferred for bread. In the

United States, the market for hard-red spring wheat was especially

volatile. Prices doubled between February 2007 and February 2008,

although new supplies from this year’s harvest have begun to ease

prices.

Wheat contributes less than 10 percent of the cost

of a typical loaf of bread in the United States. Nevertheless, its

sharp price increase triggered broad increases in the prices of baked

goods to cover the rising costs of raw materials, packaging, and

distribution. For poor consumers in developing countries who get many

of their calories from wheat products, the rising prices of bread,

wheat tortillas, chapatis, and naan had immediate and profound

nutritional consequences.

Two other disruptive forces were

at work on the wheat crop overseas. The continuing drought in

Australia, a major wheat-exporting country, was one of the few

instances of supply failure in 2007. Exports from Australia fell by

half, and since Australia traditionally supplies about 15 percent of

global wheat exports, the drop added to rising bread prices around the

world.

Second, one of the most ominous issues for the

longer-run is the outbreak of a new wheat rust, Ug99. As the name

suggests, this rust was discovered in Uganda in 1999, and its spores

then spread by wind into North Africa and the Middle East. The rust has

serious consequences for wheat yields. While actual losses to date have

been rather small, future losses could be immense. Virtually none of

the world’s wheat varieties are resistant to the rust. Especially

worrisome is its spread into South Asia where tens of millions of poor

people depend directly on wheat for the bulk of their calories. The

perception of a Ug99 threat has already had significant food-policy

consequences in India (a point we return to later).

Finally,

livestock products are part of this story about connections among

commodities. In part, they help to push prices up. The growing pork

sector in China, for example, exerted substantial upward pressures on

world soybean markets. Most livestock producers in the United States

and Europe, however, struggled to accommodate high-priced corn and

other feeds. (One important exception took the form of distillers

grains, a co-product of ethanol production. This residual is high in

protein, and, if hauled in “wet” form directly from plants to dairies

and feedlots, it provides cost advantages significant enough to

transform feed rations, and potentially, to alter the geography of beef

feedlots in the United States.)

In developed nations such

as the United States, shrinking margins on livestock production are

creating cutbacks. For example cattle have long gestation and

maturation periods, and many cowherds are now being culled. Available

meat on the market will increase in the short run, but a smaller supply

of meat will eventually push prices up. Such price hikes will be felt

mainly by middle- to upper-income households. Very poor consumers in

low-income countries rarely consume meat of any sort, and for them the

cutbacks may be an encouraging sign: their best hope is more grain

available on world markets, rather than used as livestock feed or fuel

in rich countries.

Governments that cannot provide their constituents food at affordable prices are often overthrown.

Much

more could (and should) be said about individual commodities and about

how recent macroeconomic trends have influenced the structures of

markets. The expanded role of large hedge funds in commodity markets

has increased price volatility for agricultural goods such as corn and

wheat. For example, the number of corn contracts traded on the Chicago

exchange has grown from 1 million in January 2002 to nearly 6 million

in January 2008, leading some observers to conclude that there has been

excessive financial speculation in these markets. The dollar has also

depreciated rapidly during the past several years, virtually mirroring

the rise in the price of oil. The dollar/euro price ratio is now only

about 55 percent of what it was in 2000. If all commodity prices were

quoted in euros, the price rises we have witnessed over the last two

years would have been less steep. This obvious but important point

underscores the central role that exchange rates play in both the

world-food and oil economies.

* * *

The story

thus far has focused on commodities and their market connections. But

food is much more than an economic commodity. It is also a political

commodity and the foundation for human survival. Governments that

cannot provide their constituents food at affordable prices are often

overthrown. And for those that remain in power during times of high

prices, particularly in poor countries, the challenge of feeding a

growing hungry population looms. Food riots, politics, and new policies

have all been on the forefront of the current crisis. As of April 2008,

eighteen countries had reported food riots, from Bangladesh to Egypt,

Haiti to Mexico, Uzbekistan to Senegal. About the same number of

countries, including India, Argentina, and Vietnam, erected trade

barriers on food to protect their domestic constituents.

Governments

have reacted to the crisis in different ways, and these policy

responses can have far-reaching effects in the world food economy.

India, in particular, played a pivotal role in shaping the current

crisis when its national food authority placed restrictions on staple

cereal exports in October 2007. Higher prices in the international

wheat market, coupled with the escalating threat of Ug99 and poor

weather conditions within India’s main cereal producing regions,

triggered the new policy. Faced with less domestic wheat for public

distribution and costly wheat imports, the government moved to

guarantee supplies of its other main staple crop, rice, for its

constituency. Bans were placed on exports of non-basmati varieties of

rice, wheat, and wheat flour, and wheat imports were restricted for

disease control. The move was geared in part to electoral politics—the

upcoming 2009 elections—yet it had echoes, linking rice to the

seemingly disconnected biofuels sector in the global commodity market.

Rice

has historically carried great political weight in Asia. Unlike wheat

and corn, which are much more freely traded in international markets,

rice is consumed largely in countries where it is produced, and is

exchanged to a great extent through government-to-government contracts.

Although private sector investment and trade have expanded in recent

decades, rice trade accounts for only 6 to 7 percent of total

production, and Asian governments continue to keep a close eye on

prices and availability for the sake of political stability.

Given

India’s role as the world’s second largest rice exporter—in recent

years supplying about five million metric tons or one-sixth of the

world market—its export ban sent a shock to the system. The

international rice price immediately jumped from about $300 to $400 per

ton for standard grade rice and continued to soar to unprecedented

levels as other countries reacted to the change. Shortly after India

placed restrictions on rice exports, Vietnam, China, Cambodia,

Indonesia, and Egypt followed suit. Meanwhile the Philippines—the

world’s largest importer of rice—began to place open tenders in the

world market (bids for imports at any price) in April 2008 in a

desperate act to secure adequate stocks of rice for its citizens. At

this point, the price of rice rose to $850 per ton, and soon surpassed

$1,000 per ton in May with additional tenders. But still the

Philippines struggled to secure sufficient rice at even this high

price.

Other countries fared even worse. Bangladesh

suffered a major tropical storm in November 2007 that killed 3,400

people, left millions homeless, and demolished large tracts of

agricultural land. The country lacked the financial reserves needed to

import rice, even though India made an exception to sell limited

quantities of non-basmati rice at $650 per ton. Similarly, Sub-Saharan

African countries, which import on average 40 percent of their rice

consumption (in southern African countries the number is as high as 80

percent), had no access to their usual supplies of Indian rice, and

could neither find nor afford other sources of rice in the market.

Reduced cereal imports triggered price increases in regionally grown

crops such as millet and sorghum. Although farmers who produce a

surplus of those crops have benefited, the poorest households that

consume more than they produce have had to go with less, and have no

doubt suffered increased malnutrition.

We

are only beginning to understand the toll of price increases on the

world’s least developed and low-income food-deficit countries, many of

which are in Sub-Saharan Africa. The Food and Agriculture Organization

estimates that the 2008 food-import bill for these countries will rise

up to 40 percent above 2007 costs, after rising 30 and 37 percent,

respectively, the previous two years. The cost of annual food imports

for these regions is now four times what it was at the beginning of the

decade, even though import volumes have declined. The World Bank

predicts that with these rising costs, declining imports, and

increasing domestic prices of agricultural commodities, millions of

people will fall quickly into chronic hunger.

Cameroon has

experienced some of the worst strife as a result of high consumer

prices. Roughly 1,600 protesters were arrested and 200 were sentenced

in the first few weeks after riots broke out in February 2008. In an

attempt to extend his quarter-century run in office, President Paul

Biya’s government not only clamped down on riots but also cut import

duties and pledged to increase agricultural investments and

public-sector wages.

In Argentina, a different form of

food riot broke out against the newly elected President Cristina

Fernandez de Kirchner when she raised export taxes on soybeans and

implemented new taxes on wheat and other farm exports in order to hold

domestic food prices down. Four months of nationwide protests by farm

groups eventually persuaded the government to revoke these tax

increases in mid-July, but political tension remains.

Governments

thus walk a thin line between consumer- and producer-oriented

incentives. Export restrictions in times of high world prices may help

consumers, but they prevent agricultural producers from realizing

economic gains. Interventions of this sort may help in the short-term,

but they are extremely hard to retract. For example, many Asian

countries implemented trade restrictions on rice in the mid-1970s in

response to high prices, short supplies, and political unrest, and

these policies remained in effect for over two decades. It is clear

that policies designed to stabilize domestic prices often destabilize

international ones. And advocating international cooperation as a

solution is naïve, as evidenced by the repeated (and recent) failure of

World Trade Organization negotiations over the topic of coordinated

agricultural policies.

* * *

The

international community is addressing the mounting crisis in different

ways. The United Nations World Food Program (WFP) received $2.6 billion

in contributions for the first six months of 2008—almost as much as it

received for the full year in 2007, but still below the amount needed

to feed the growing number of starving people worldwide. Food aid

deliveries in 2007 fell to their lowest levels since 1961, and the

outlook for 2008 remains sobering.

The United States has

earmarked about $2 billion for food aid through its Public Law 480

program, more than any other country. However, only about 40 percent of

this amount is spent on food; the rest goes to transportation and

administration to meet Congressional mandates that U.S.-produced

commodities committed as aid must be shipped to their destinations on

U.S.-flagged vessels. With energy prices soaring, the cost of shipping

food aid over long distances has increased by more than 50 percent

during the past year, and the actual amount of food aid has decreased.

An increasingly embarrassing cycle has evolved whereby U.S. food aid is

reduced when costs are high and food is most needed by the poor (see U.S. Food Aid Shipments and Grain Prices, 1980-2007).

The

food system is indeed global, yet the principal actors are national

governments, not international agencies. The latter can help with

solutions, but fundamental improvements require more enlightened

national policies.

Canada and the European Union,

meanwhile, have followed the WFP strategy by providing food aid in the

form of cash to relief agencies in needy countries. The agencies then

purchase supplies regionally, a practice that reduces transportation

costs and boosts local agricultural markets. A proposal to endorse this

strategy in the United States fell flat in the Congress and was

countered in the Senate by a bill that would spend $60 million over

four years to study the idea.

Food assistance, however, is

a band-aid, not a cure, especially because it may provide major

disincentives for agricultural development in poor regions. Ironically,

the United States, the largest donor of food aid, is one of the

smallest donors (relative to GDP) of international development aid.

Agricultural development has been largely eliminated from the agenda of

the U.S. Agency for International Development in recent decades and the

agency has lost most of its agricultural expertise. (When polled,

Americans believe that up to one-quarter of the U.S. federal budget is

spent on foreign aid, when in fact the share is less than 1 percent. If

voters had the numbers in better perspective, perhaps they would push

for an increase in assistance.)

Over the longer run, only

sustained growth in agricultural productivity can reduce the

vulnerability of all countries to the chaos created by food crises.

This conclusion is especially true for poor countries where over half

of the workforce derive their principal income from agriculture, and

the farm sector accounts for a sizeable share of GDP. But even rich

countries such as the United States require continued investments in

agricultural productivity—a point made clear by the fact that a large

share of the corn crop now goes to fuel American gas tanks.

Unfortunately, growth in public-sector investments in agricultural

productivity research has slowed in many countries, rich and poor,

although China, India, and Brazil have been clear exceptions.

Private-sector agricultural investments have been more robust but have

been focused mainly in rich countries and have resulted in the

proliferation of biotechnology patents that have kept innovation

largely out of public hands. The gap between the “haves” and

“have-nots” of agricultural research is thus widening.

This

pattern of agricultural investments is a key culprit in the current

crisis, and it will continue to create serious problems for consumers

worldwide if crop-based biofuel use expands further. Globally,

agricultural productivity growth (2 percent per year from 1980-2004) is

barely outpacing population growth (1.6 percent per annum). And even

this minimal progress has not been evenly spread. Asia, and in

particular China, has dominated the positive trend, while Sub-Saharan

Africa has faltered with its grain yield at one-quarter that of East

Asia’s 1.6 tons per acre. (The industrialized world produced 2.4 tons

per acre in 2004). Fortunately, bilateral donors are now taking an

increasing interest in Sub-Saharan Africa, as are several important

private foundations (a point discussed more thoroughly in the May / June 2008 issue of Boston Review).

The

World Bank is in a position to reinvigorate agricultural development,

both financially and symbolically. What is it currently doing to help?

Fortunately, Robert Zoellick is providing international leadership on

global agriculture that has long been overdue at the Bank. Allocations

for agricultural development are now up; for example, the Bank has

pledged to double agricultural lending in Africa from $400 million to

$800 million in 2009. Yet the steady decline in the Bank’s investments

in agricultural research and development, cuts in its technical staff

on agricultural development, and reductions in overall allocations to

agriculture (from about 25 percent of total Bank lending in the

mid-1980s to 10 percent in 2000) have done little to bolster

infrastructure and agricultural capacity in the countries worst hit by

the crisis. The non-trivial issues of corruption and poor governance in

several African countries are partially to blame for this decline: Bank

leaders have argued for funding cuts on the grounds that money given

directly to governments for agricultural development never reaches

targeted projects. But the Bank’s leadership (prior to Paul Wolfowitz

and now Zoellick) also lacked vision regarding the importance of

agricultural development. The World Bank does not stand alone in this

neglect; for example, the Asian Development Bank recently decided to

omit agriculture from its lending portfolio. It is time for the

international community of aid institutions and national governments to

change direction on this issue.

* * *

It is

one thing to commit to the new forms of food aid and additional

investments in crop productivity needed to work through the current

food crisis. It is quite another to plan for what will be needed to

keep the world out of a perpetual food crisis in the face of global

climate change. With increasing temperatures, rising sea levels,

changing precipitation patterns, new pest and pathogen pressures, and

reduced soil moisture in many regions, the impact on the agricultural

sector is likely to be especially severe. How can the international

community grapple with the present challenges in the world food economy

and still keep agricultural productivity ahead of a changing climate?

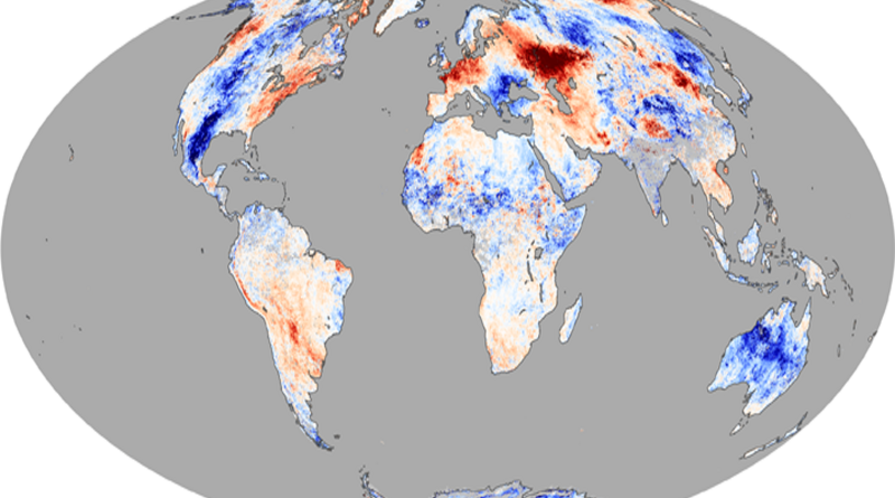

Predicting

climate conditions decades in advance involves many uncertainties.

Nonetheless, some twenty global climate models (also known as general

circulation models) considered by the Intergovernmental Panel on

Climate Change broadly agree on three points. First, all regions will

become warmer. The marginal change in temperature will be greater at

higher latitudes, although tropical regions are likely to be more

sensitive to projected temperature changes because they have

experienced less variation in the past. Second, soil moisture is

expected to decline with higher temperatures and increased rates of

evapotranspiration in many sub-tropical areas. These factors will lead

to sustained drought conditions in some areas and flooding in others

where rainfall intensity increases but soil moisture decreases. And

third, sea levels will rise globally with thermal expansion of the

oceans and glacial melt, with especially devastating consequences for

small island states and for low-lying and highly populated regions.

Large

areas of Bangladesh already flood on an annual basis and are likely to

be submerged completely in the future. Moreover, the rapid melting of

the Himalayan glaciers, which regulate the perennial flow in large

rivers such as the Indus, Ganges, Brahmaputra, and Mekong, is expected

to cause these river systems to experience shorter and more intense

seasonal flow and more flooding, thus affecting large tracts of

agricultural land.

Increased temperature and drought will

pose large risks to food insecure populations, particularly in

Sub-Saharan Africa and South Asia. Research at the University of

Washington and Stanford University predicts that average growing season

temperatures throughout the tropics and sub-tropics will rise above the

bounds of historical extremes by the end of the century. Yield losses

are expected be as high as 30-50 percent for corn in southern Africa if

major adaptation measures are not pursued. Africa as a whole is

particularly vulnerable to climate change since over half of the

economic activity in most of the continent’s poorest countries is

derived from agriculture, and over 90 percent of the farming is on

rain-fed lands.

Given the inevitable changes in climate

over the coming decades, what forms of adaptation are needed, and how

can the international community help?

One strategy is

based on developing new crop varieties resistant to climate-induced

stresses (heat, drought, new pests and pathogens). Introducing these

climate-tolerant traits in crops will require continued collection,

evaluation, deployment, and conservation of diverse crop genetic

material, because the diversity of genetic resources is the building

block for crop breeding. In the absence of such efforts, even temperate

agricultural systems will suffer yield losses with large increases in

seasonal temperature.

Misguided domestic policies [in the U.S. and abroad] are also driving the crisis.

Additional

adaptation strategies include investments in irrigation and

transportation infrastructure and the design of climate information and

insurance networks for farmers. The creation of non-farm employment

will also help reduce climate change impacts in cases like the Sahel

(the northern section of Africa below the Sahara desert and above the

tropical zone) where agriculture may simply be unviable in the future.

All

of these strategies involve large-scale investments in “public goods”

that the private sector cannot be expected to fill. The U.S.

government, for one, needs to recognize the global consequences of

climate change and contribute to such public investments. Other

governing bodies (e.g., those of Canada, the European Union, and East

Asian countries) and international development organizations also need

to play a greater role. Promoting pro-poor investments in agricultural

productivity research and implementation—not allowing such investments

to fall off the agenda—is the key to food security in the face of

climate change. The future will look very much like a continuation of

the current crisis—or indeed much worse—without such investments.

* * *

The

complexity of the food crisis across commodities, space, and time makes

it difficult to give a precise statement of causes. That said, the

direct and indirect effects of increased ethanol production in response

to rising oil prices seem to have pushed an already tight food system

(with weak investment in innovation) over the edge. The U.S. Department

of Agriculture’s assessment that biofuels were 3 percent of the problem

completely lacks credibility, and the International Food Policy

Research Center’s estimate of 30 percent may also be too low. What

happens to future corn and vegetable oil prices, and therefore to the

entire structure of food prices, is dependent primarily on the price of

oil and on whether the new biofuel mandates for ethanol in the United

States and biodiesel in Europe are imposed or rescinded.

The

price of oil, in particular, is a fundamental factor in the overall

equation. In a world of $50-per-barrel oil, growth in biofuels would

have been more limited, with a much smaller spillover onto food prices.

But the links that have emerged between agricultural and energy sectors

will shape future investments and the well-being of farmers and

consumers worldwide.

Misguided domestic policies serving

particular groups of constituents in a wide range of countries are also

driving the crisis. Export bans on food in response to populist

pressures are likely to yield small and short-lived gains, while

producing large and long-term damage to low-income consumers in other

countries. The food system is indeed global, yet the principal actors

are national governments, not international agencies. The latter can

help with solutions, but fundamental improvements require more

enlightened national policies.

As Zoellick’s passage at

the beginning of this essay implies, much of the current crisis could

have been avoided and can be fixed over time. Individuals, national

governments, and international institutions took agriculture for

granted for twenty years, and their neglect has now caught up with the

world. Fortunately, high food prices and the resulting political

upheaval have induced national governments and such international

institutions as the World Bank to pledge greater investments in

agricultural development. Unfortunately, these pledges only came as a

response to widespread malnutrition among the world’s poorest

households.

In response to rising demand and higher

prices, some new sources of supply are emerging, including soybean

expansion in Brazil and oil palm expansion in Indonesia. However, the

environmental impacts of such expansion, particularly when it involves

clearing tropical rainforests, are potentially serious. Similarly,

efforts to increase crop yields in existing agricultural areas are

leading to greater fertilizer inputs and losses to the surrounding

environment. The trade-offs between agricultural productivity and

environmental sustainability, particularly in an era of climate change,

appear to be more extreme than ever before.

The current

food crisis has different origins than previous global food crises, and

will require different solutions. It also differs from famines in

isolated geographic areas for which food aid and other palliatives can

provide quick fixes. The present situation is instead reflected in

higher infant mortality and poverty rates over a much wider geography.

Given the underlying pressures of growing population, increasing global

incomes, and the search for oil substitutes, leaders in both the public

and private sectors in developed and developing nations need to be

serious about expanded agricultural investments and improved food

policies. Otherwise, the current situation will only get worse,

especially for the 40 percent of the world’s population that is already

living so close to the edge.